In that case you might have to recognize the full amount of the sales price as ordinary income (not the sales price minus the tax basis of the item, as in the usual case). You would continue to depreciate the entire group of assets for the remainder of the class life, including the asset you’ve already sold. For example, if you purchase five computers to use in your business in Year A, you can create a general asset account for them. However, if you purchase four computers and a desk, you cannot include the desk in the asset group with the computers because the recovery periods are different. If you do not use the asset 100 percent for business, then each year you must multiply the asset’s total tax basis by the business percentage for that year, and then multiply the result by the fraction found in the table.

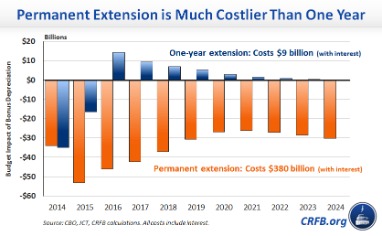

- Since Congress has changed the depreciation rules many times over the years, you may have to use a number of different depreciation methods if you’ve owned business property for a long time.

- The main drawback of SYD is that it is markedly more complex to calculate than the other methods.

- Deciding what depreciation method to use will affect your net income.

- Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

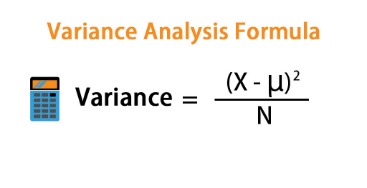

But in other circumstances, a machine frequently becomes obsolete even before it breaks down due to quick technological changes. When someone uses the asset consistently, eventually, one has to replace it when it does not work. Thus, it will be extremely difficult to obtain money to substitute the asset throughout its lifespan if they do not charge degradation against the profits. As a result, it’s important to plan and raise money to replace these assets when they’re needed. Depreciation is equal to two times the straight-line depreciation rate multiplied by the initial book value of the accounting period. (Asset Cost – Remaining Value) / Useful life of the asset is the annual depreciation expense.

Why Should Depreciation Expenses Be Tracked?

So, for our example, let’s imagine your company purchased an asset worth $10,000. Now we can plug those figures in to find the annual depreciation expense. Accounting principles state that you have to choose a way to decrease the value of an asset and stick with it. This means that for all accounting periods, you’ll calculate depreciation until the asset life has expired.

This method is good for businesses that want to write off equipment with a quantifiable and widely accepted (i.e., based on the manufacturer’s specifications) output during its useful life. Make sure you have a method in place for tracking your use of equipment, and expect to write off a different amount every year. Once their service life expires, the company’s assets must be replaced.

Asset depreciation FAQ

Small businesses looking for the easiest approach might choose straight-line depreciation, which simply calculates the projected average yearly depreciation of an asset over its lifespan. Since different assets depreciate in different ways, there are other ways to calculate it. Declining balance depreciation allows companies to take larger deductions during the earlier years of an assets lifespan.

- Assets that have little useful life and/or are low-cost are considered expenses, so not depreciable.

- You can elect to use the slower ADS depreciation even if you are not required to use it by law.

- The units of production method calculates depreciation based on the number of units produced in a particular year.

SYD suits businesses that want to recover more value upfront, but with more even distribution than they would otherwise get using the double-declining method. The SYD method’s main advantage is that the accelerated depreciation reduces taxable income and taxes owed during the early years of the asset’s life. The main drawback of SYD is that it is markedly more complex to calculate than the other methods. This method is another common way to calculate depreciation for businesses, however, it’s a mouthful.

Calculating Depreciation Using the Straight-Line Method

The sum-of-the-years’-digits method (SYD) accelerates depreciation as well but less aggressively than the declining balance method. Annual depreciation is derived using the total of the number of years of the asset’s useful life. The SYD depreciation equation is more appropriate than the straight-line calculation if an asset loses value more quickly, or has a greater production capacity, during its earlier years. Consider a machine that costs $25,000, with an estimated total unit production of 100 million and a $0 salvage value.

10 Luxury Cars That Depreciate the Fastest – Yahoo Finance

10 Luxury Cars That Depreciate the Fastest.

Posted: Fri, 25 Aug 2023 07:00:00 GMT [source]

The van’s book value at the beginning of the second year is $15,000, or the van’s cost ($25,000) subtracted from its first-year depreciation ($10,000). Now, multiply the van’s book value ($15,000) by 40% to get a $6,000 depreciation expense in the second year. Let’s say you want to find the van’s depreciation expense in the first, second, and third year you own it. Multiply the van’s cost ($25,000) by 40% to get a $10,000 depreciation expense in the first year. It has a salvage value of $3,000, a depreciable base of $27,000, and a five-year useful life.

What Is Depreciation in Business?

This method calculates depreciation using a formula that takes into account the asset’s useful life and the number of years it has been in use. However, its simplicity can also be a drawback, because the useful life calculation is largely based on guesswork or estimation. It also does not factor in the accelerated loss of an asset’s value economic efficiency in the short term or the likelihood that maintenance costs will go up as the asset gets older. The estimation of the useful life of an item of property, plant and equipment is a matter of judgment based on the experience of the entity with similar assets. In other words, depreciation is simply a process of allocation and not of valuation.

The second aspect is allocating the price you originally paid for an expensive asset over the period of time you use that asset. Depreciation is often misunderstood as a term for something simply losing value, or as a calculation performed for tax purposes. Depreciation is an important part of your business’s tax returns, but it is a complex concept. Keep reading to learn what depreciation is, how it is calculated and how your depreciation calculation can affect your business. Older equipment owners discard as newer, better models become available. Therefore, discoveries, changes in tastes and styles, the state of the market, governmental regulations, etc., are the reasons why the worth of an item is discarded.

Fixed asset depreciation software is an effective way of managing your company’s assets. It should have the ability to use more than one method where appropriate for comparison purposes. Fixed asset depreciation software is the perfect way to ensure that the regular depreciation of your fixed assets is done uniformly, consistently, and accurately, without relying on error-prone manual calculations. Deciding what depreciation method to use will affect your net income. For instance, under the accelerated depreciation methods there will be a higher depreciation expense in the early years compared to a straight line method. It is important to understand how each method will affect things such as taxes, as different methods recognize expenses at different times.

Get the best trade-in value for your iPhone 14 with Decluttr – 9to5Mac

Get the best trade-in value for your iPhone 14 with Decluttr.

Posted: Mon, 04 Sep 2023 19:42:00 GMT [source]

The depreciation method should take into account the expected useful life of the asset. (Asset cost – Residual Value) / Useful life of the asset is the annual depreciation expense. Depreciation is a crucial component of an accounting system that aids businesses in maintaining accurate profit statistics on their financial statement. Using successful company depreciation software, you may avoid human errors and accurately record the devaluation. Follow Khatabook for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.

There are several different methods of depreciation that can be used, each with its advantages and disadvantages. By understanding the different types of depreciation and their calculations, companies can choose the method that best suits their needs and accurately reflect the decrease in value of their assets over time. Another accelerated depreciation method, SYD results in larger depreciation amounts early in the life of an asset, but not as aggressively as declining balance. This method is geared towards assets that lose value quickly or produce at a higher capacity during the early years. To start, a company must know an asset’s cost, useful life, and salvage value. Then, it can calculate depreciation using a method suited to its accounting needs, asset type, asset lifespan, or the number of units produced.

To calculate composite depreciation rate, divide depreciation per year by total historical cost. To calculate depreciation expense, multiply the result by the same total historical cost. The result, not surprisingly, will equal the total depreciation per year again.

Depreciation is any method of allocating such net cost to those periods in which the organization is expected to benefit from the use of the asset. Depreciation is a process of deducting the cost of an asset over its useful life.[3] Assets are sorted into different classes and each has its own useful life. Depreciation is technically a method of allocation, not valuation,[4] even though it determines the value placed on the asset in the balance sheet. You can use accounting software to track depreciation using any depreciation method. The software will calculate the annual depreciation expense and post it to the necessary journal entries for you. An accounting solution can help you make more informed decisions to grow your business with confidence.