Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study.

- Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends. - Dan has served as the CFO at Shockwave since he joined the company in 2016.

- At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

- Its intravascular lithotripsy technology is used in the treatment of calcified plaque.

It also provides product for the treatment of coronary artery disease, such as C2 IVL catheter and C2+IVL catheter that are two-emitter catheters for use in IVL system. It serves interventional cardiologists, best prepaid debit cards vascular surgeons, and interventional radiologists through sales representatives and managers, and distributors. The company was incorporated in 2009 and is headquartered in Santa Clara, California.

Financials

There are currently 1 hold rating and 6 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should “moderate buy” SWAV shares. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses.

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return.

To begin with, Shockwave Medical has a pretty high ROE which is interesting. Additionally, the company’s ROE is higher compared to the industry average of 9.2% which is quite remarkable. As a result, Shockwave Medical’s exceptional 75% net income growth seen over the past five years, doesn’t come as a surprise. Remarks from a healthcare company executive got investors excited about medical device makers. The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest.

Dow posts biggest gain in 5 weeks, stocks end higher

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company’s expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is Shockwave Medical fairly valued compared to other companies? The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Stock Quote

(SWAV) raised $75 million in an initial public offering on Thursday, March 7th 2019. The company issued 5,000,000 shares at a price of $14.00-$16.00 per share. Morgan Stanley and BofA Merrill Lynch acted as the underwriters for the IPO and Wells Fargo Securities and Canaccord Genuity were co-managers. MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. Given that Shockwave Medical doesn’t pay any dividend to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

- The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries.

- This section shows the Highs and Lows over the past 1, 3 and 12-Month periods.

- The ‘return’ is the amount earned after tax over the last twelve months.

- Next, on comparing with the industry net income growth, we found that Shockwave Medical’s growth is quite high when compared to the industry average growth of 9.3% in the same period, which is great to see.

- We aim to bring you long-term focused analysis driven by fundamental data.

The company is scheduled to release its next quarterly earnings announcement on Monday, November 6th 2023. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Compare

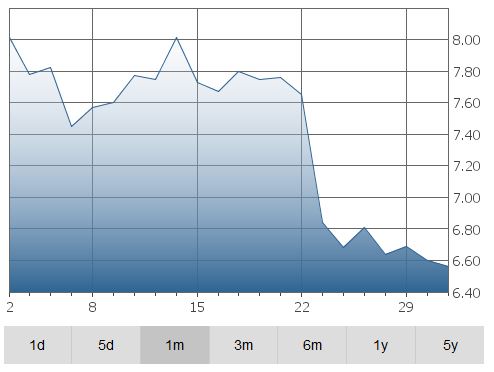

SWAV’s historical performance

against its industry peers and the overall market.

About MarketBeat

Upgrade to MarketBeat All Access to add more stocks to your watchlist. 8 employees have rated Shockwave Medical Chief Executive Officer Doug Godshall on Glassdoor.com. Doug Godshall has an approval rating of 89% among the company’s employees. Sign-up to receive the latest news and https://1investing.in/ ratings for Shockwave Medical and its competitors with MarketBeat’s FREE daily newsletter. Our Quantitative Research team models direct competitors or comparable companies

from a bottom-up perspective to find companies describing their business in a

similar fashion.

Shockwave Medical’s stock is owned by many different institutional and retail investors. Ltd Zurich (10.15%), BlackRock Inc. (9.90%), Artisan Partners Limited Partnership (3.13%), State Street Corp (2.77%), Geode Capital Management LLC (1.54%) and Allspring Global Investments Holdings LLC (1.30%). Insiders that own company stock include Antoine Papiernik, Colin Cahill, Dan Puckett, Douglas Evan Godshall, Frank T Watkins, Frank T Watkins, Isaac Zacharias, Kurt F Gallo, Laura Francis, Maria Sainz, Sara Toyloy and Trinh Phung.

ShockWave Medical Inc is a medical device company focused on developing and commercializing products intended to transform the way calcified cardiovascular disease is treated. Its intravascular lithotripsy technology is used in the treatment of calcified plaque. Geographically, the company generates its revenue from the United States, Europe and other countries. SANTA CLARA, Calif., Sept. 11, (GLOBE NEWSWIRE) — Shockwave Medical, Inc. SWAV, a pioneer in the development and commercialization of transformational technologies for the treatment of cardiovascular disease, announced today that Chief Financial Officer Dan Puckett plans to retire in the first quarter of 2024. Dan has served as the CFO at Shockwave since he joined the company in 2016.

This of course has caused the company to see substantial growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company’s earnings growth is expected to slow down. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company. Shockwave Medical issued an update on its FY 2023 earnings guidance on Monday, August, 7th. The company provided earnings per share (EPS) guidance of for the period. The company issued revenue guidance of $725.00 million-$730.00 million, compared to the consensus revenue estimate of $716.10 million.

SWAV’s beta can be found in Trading Information at the top of this page. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. One’s a growth stock and the other pays a dividend but both of these healthcare businesses have what it takes to reliably outperform. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Oracles Gen2 Cloud Attracts 4 Billion in Contracts Solidifying AI … – Best Stocks

Oracles Gen2 Cloud Attracts 4 Billion in Contracts Solidifying AI ….

Posted: Mon, 11 Sep 2023 20:26:40 GMT [source]

Shockwave Medical is a leader in the development and commercialization of novel technologies that transform the care of underserved patients with cardiovascular disease. Through the recent acquisition of the Reducer, which is under clinical investigation in the U.S. and is CE Marked in the EU and UK, Shockwave Medical plans to introduce its second transformative technology to the interventional cardiology community. By redistributing blood flow within the heart, the Reducer is designed to provide relief to the millions of patients worldwide suffering from refractory angina who have no other treatment options. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature.

More value-oriented stocks tend to represent financial services, utilities, and energy stocks. These are established companies that reliably pay dividends. Overall, we are quite pleased with Shockwave Medical’s performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return.

Why Shockwave Medical Stock Dropped Today – The Motley Fool

Why Shockwave Medical Stock Dropped Today.

Posted: Tue, 08 Aug 2023 07:00:00 GMT [source]

Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. One share of SWAV stock can currently be purchased for approximately $221.12.

Click the “See More” link to see the full Performance Report page with expanded historical information. Provides a general description of the business conducted by this company. The Barchart Technical Opinion rating is a 72% Sell with a Strengthening short term outlook on maintaining the current direction. What you need to know… The S&P 500 Index ($SPX ) (SPY ) Monday closed up +0.24%, the Dow Jones Industrials Index ($DOWI ) (DIA ) closed up +0.62%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) closed up +0.06%…. The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.32% per year. These returns cover a period from January 1, 1988 through July 31, 2023.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. This section shows the Highs and Lows over the past 1, 3 and 12-Month periods.